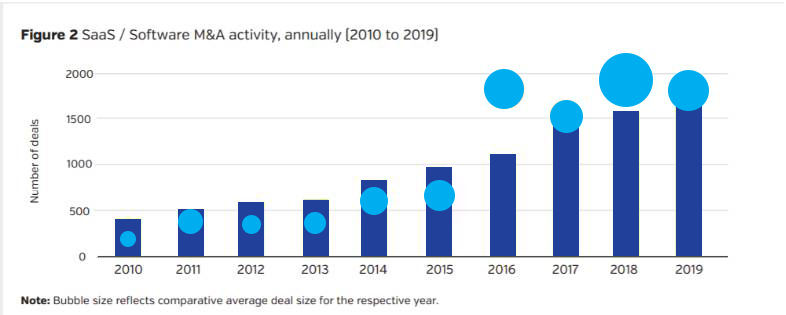

With a 12x growth rate since 2010, it is safe to say that SaaS is a business model of the 21st century. Investors have been placing the greatest bets on SaaS companies as well. With the global Software as a Service (SaaS) market size projected to reach USD 307.3 Billion by 2026, the success of Twilio, Zoom, and Shopify is drawing the sharp attention of investors as the three SaaS vendors have been trading at 20x, 37x, and 51x their initial values.

Adobe too has seen its fortunes turn, in a large part due to its transition to the cloud.

“We always had the right motivation, which is: How can we innovate at a faster pace? How can we aggressively acquire new customers and how can we continue to build a more predictable and recurring revenue stream?” – Shantanu Narayen, Adobe CEO, on why they moved Adobe to the cloud

In 2012, Adobe Inc. launched a Software-as-a-Service (SaaS) subscription version of its key product line, Creative Suite, causing its net income to plummet by almost 35% percent the following year. Moving to the cloud also presented opportunities for Adobe to protect itself against competing products. With more design tool competitors (like InVision and UXPin) and point solutions (like Sketch) available on cloud-based subscription plans, users could try out Adobe competitors with very little risk. These cloud-based solutions could also roll out updates and improvements whenever they needed to, as opposed to Adobe’s 18-24 month cycle of product releases. All of these factors weakened the lock-in that Adobe previously had with its users.

So, why should you move to SaaS?

- Capital Efficiency: “SaaS companies are extremely capital-efficient. You can build a large, profitable business for less than $10m in funding,” says Sarah Nöckel, seed investment manager at VC firm Northzone. Most public SaaS companies need less than $1 of capital to acquire $1 of ARR. Moving to a capital-efficient growth model is a good idea in good times and in bad. In good times, you will be rewarded with higher valuations. If bad times hit, you’ll already be a veteran at operating efficiently and relentlessly monitoring your deal health.

- Recurring Revenues: SaaS is built on subscription-based transactions that recur monthly or annually. This makes SaaS extremely predictable and measurable.

- Built to scale: SaaS companies can be scaled much faster and with lesser risk. With zero overhead, packaging and distribution costs, SaaS businesses are focused on growing metrics like Lifetime Value (LTV) and Monthly Recurring Revenue (MRR) while minimizing customer acquisition costs (CAC) and churn rates. As the business scales, the cost of servicing each customer goes down. In the long run, this leads to a growing and predictable cash flow. The Emerging Cloud Index (which tracks the valuation of software companies) regularly outperformed the Nasdaq in 2020, while the Scaleup Index from Beauhurst and the Scaleup Institute found SaaS companies provided the most scaleups (defined as a business with a 20% growth in annual turnover or employees) in the UK, with almost 100 more than any other sector.

- Low Barriers: SaaS has a flexible and clear licensing model, erasing barriers to entry for software and allowing entrepreneurs to enter into niche areas. This also creates a diaspora of lucrative opportunities for investors to choose from.

- Customers want SaaS: Investors are drawn to SaaS businesses as it’s been proven that customers want SaaS. While previously, people were willing to put large amounts of money into purchasing one piece of software that they would own for a long period of time (like putting a mortgage on a house), people in the modern era want things to be flexible, they want to pay less money less frequently, and they want something that they can access instantly but also drop instantly (like renting a property short-term). This in turn makes SaaS attractive to investors, as they know there’s a market for it so it is less likely to flop. As a SaaS business, the offerings are easy to use for customers. All they have to do is log in, and they’re provided with onboarding, best practices and samples in an instant. There is no complicated software to install and figure out, so they can start using the application right away. You can also upsell to existing customers offering them more storage, more data, additional features, or more accounts.

- Updates: Adding new features and upgrades with on-premise software isn’t easy. Using the Saas business model, updates and new features can be easily added and offered to users right away.

One way of creating new product lines is through acquisitions. Some of Adobe’s acquisitions, like Omniture, gave Adobe the ability to add a completely new set of tools into their product offerings. Others, like the Aldus acquisition, doubled the size of the team and brought in talent like Bruce Chizen who went on to have a huge impact at Adobe. Meanwhile, the Macromedia acquisition helped Adobe to take a competitor off the map and end a crash course where the two companies were set to collide.

We at Growthpal understand the aspirations of the Enterprise Tech in India and help them identify the right partner to grow their business. With our wide range of coverage of early-stage startups across sectors, we will source and provide the best of the recommendations thus increasing your probability of winning the transaction. Are you ready for the next big leap? Let’s discuss at [email protected]

Sources:

Sources: Harvard Business Review, Forbes, Business Insider, Deloitte, PR Newswire, Oracle NetSuite, Product Habits, Gartner, Tech Crunch

Sources: Harvard Business Review, Forbes, Business Insider, Deloitte, PR Newswire, Oracle NetSuite, Product Habits, Gartner, Tech Crunch