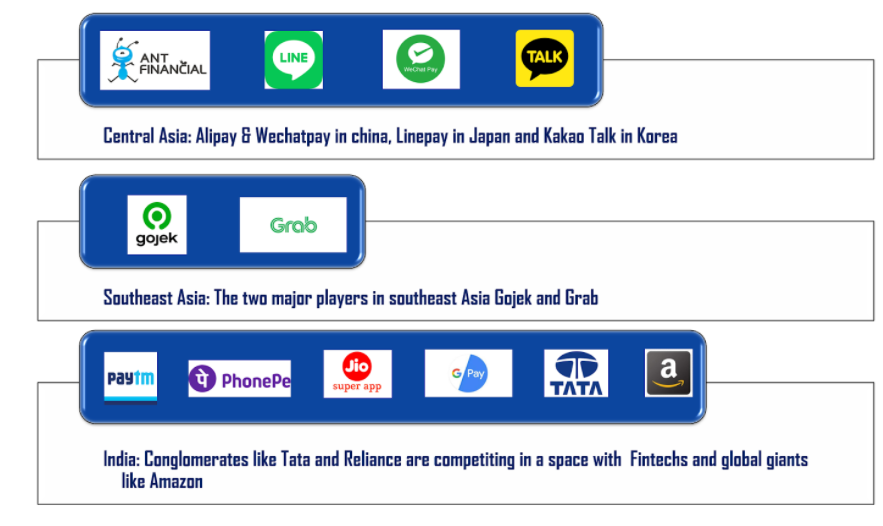

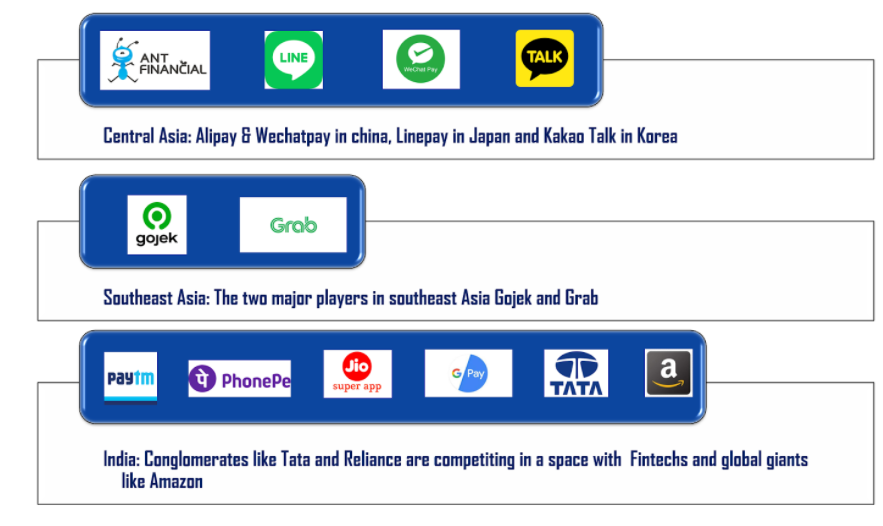

Banking and Financial services are the hardest to disrupt in the market than anything else as it involves the element of trust and it takes time to build. In the Asian market, SuperApps has been spearheading in providing financial products to the last mile. Many such companies started off as a messaging network or a ride-hailing app and then added a payment platform to transact at almost any of the platforms like e-commerce, entertainment, mobility solutions, etc. This stickiness has given rise to cross-selling of various financial products to the customers like insurance, investments or credit lines.

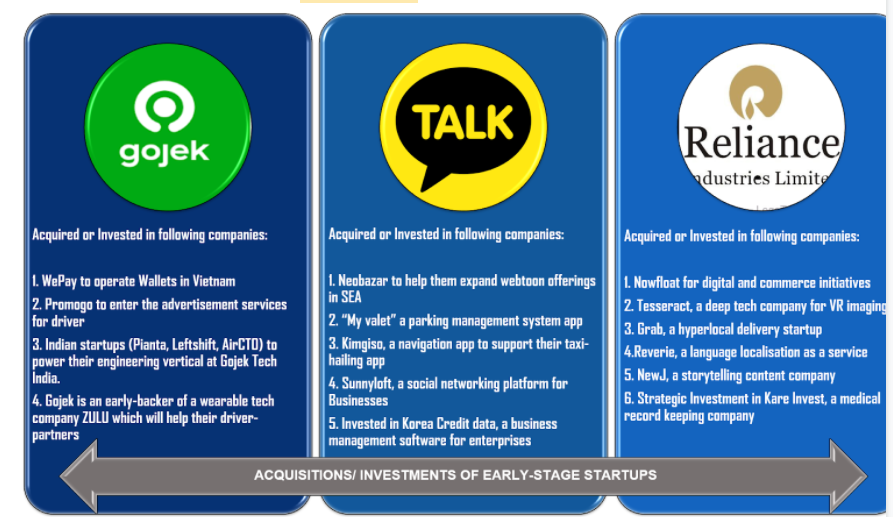

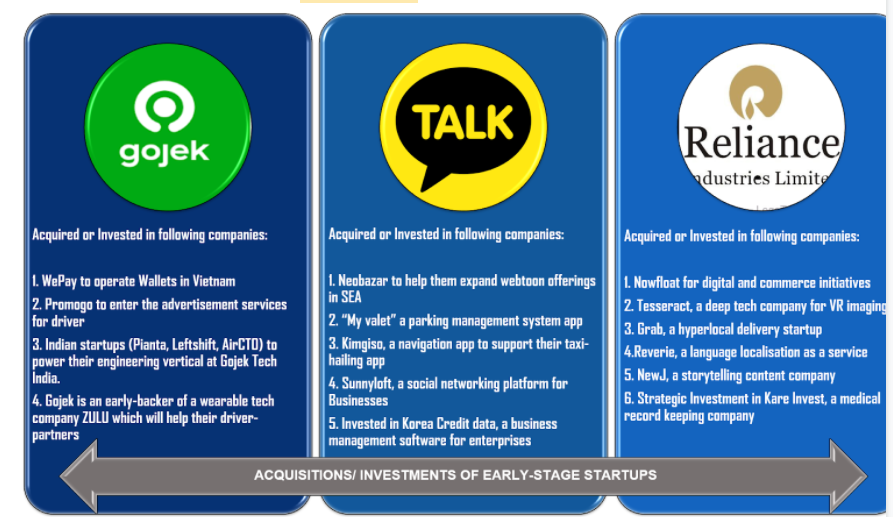

Bundling all the services and providing it to the customers on the platform takes a lot of integrations with the third-party players. And wherever there is a high demand for services, the company intends to build or buy the product and provide the service from their end. This is the initiation of inorganic growth opportunities for most of the SuperApp companies in Asia.

Let us take a look at some of the acquisitions of early-stage startups by the top players in the region

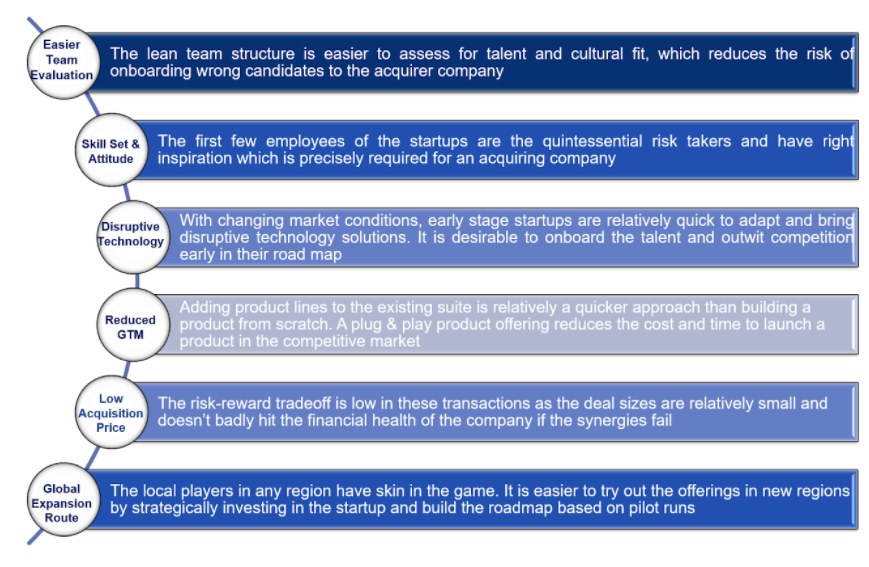

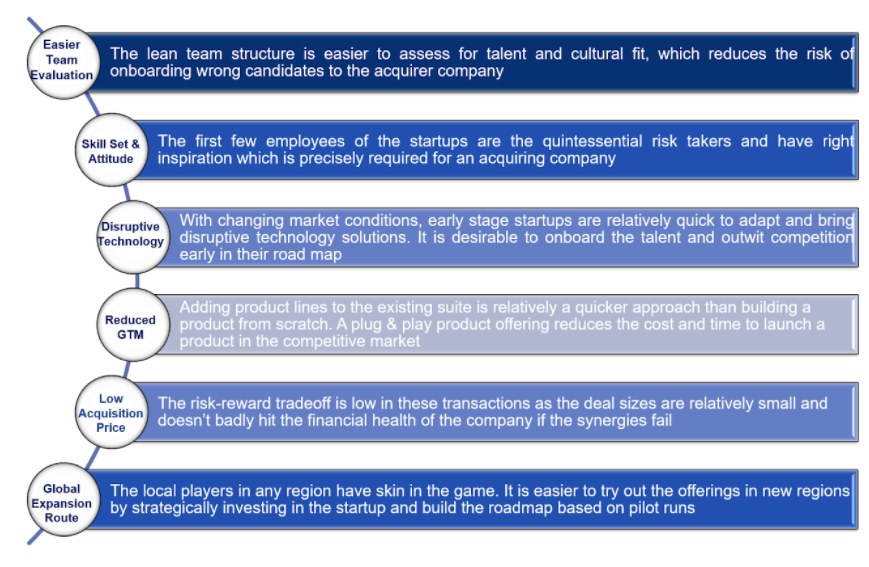

Factors making micro-acquisitions attractive for corporates and High-Growth Startups

Nutriglow will help Goat to expand in the personal care segment which is one of the fastest-growing D2C segments in India.

Nutriglow has more than 2million loyal customers and the team is hungry for growth.

A timely conversation of GrowthPal with Nutriglow led to them joining hands with Goat Brand Labs to raise the growth bar.

GOAT Brand Labs, a digital D2C accelerator program that acquires private label businesses and e-commerce brands recently closed a deal through Growthpal.

TrueBrowns will help Goat Brand Labs to expand the offerings in the fashion category. TrueBrowns has more than 50K Satisfied customers and 2x growth year-on-year.

A timely conversation of GrowthPal with TrueBrowns led to them joining hands with Goat Brand Labs to raise the growth bar.

Read More

GOAT Brand Labs, a digital D2C accelerator program that acquires private label businesses and e-commerce brands recently closed a deal through Growthpal.

Smart Shelter is a D2C company offering home care items to consumers. On the other hand.

The acquisition will strengthen GOAT Brand Labs presence as a D2C accelerator program and enable founders & their brands to scale rapidly.

GOAT Brand Labs, a digital D2C accelerator program that acquires private label businesses and e-commerce brands recently closed a deal through Growthpal.

In a world of synthetic solutions, Neemli is changing the status quo of skincare.

The acquisition will strengthen GOAT Brand Labs presence as a D2C accelerator program and enable founders & their brands to scale rapidly.

GOAT Brand Labs, a digital D2C accelerator program that acquires private label businesses and e-commerce brands recently closed a deal through Growthpal.

Doggie Dabbas is a fresh & frozen pet food brand.

The acquisition will strengthen GOAT Brand Labs presence as a D2C accelerator program and enable founders & their brands to scale rapidly.

TERA will help to create a credit line and serve the credit needs of over RazorPay’s 10,000 businesses in India by leveraging its entire technology stack, risk management capabilities, and onboarding solutions for Razorpay’s merchant network.

The acquisition of xGrow will help Innoviti to integrate the digital customer acquisition tools to its payment platform. This will now enable SMBs to advertise and acquire customers at lowest cost and extract higher value from each transaction.

GOAT Brand Labs, a digital D2C accelerator program that acquires private label businesses and e-commerce brands recently closed a deal through Growthpal.

Abhishti is an internet first D2C brand offering ethnic wear for women and has a strong position in the e-commerce apparel market.

The acquisition will strengthen GOAT Brand Labs presence as a D2C accelerator program and enable founders & their brands to scale rapidly.